income tax rate in india

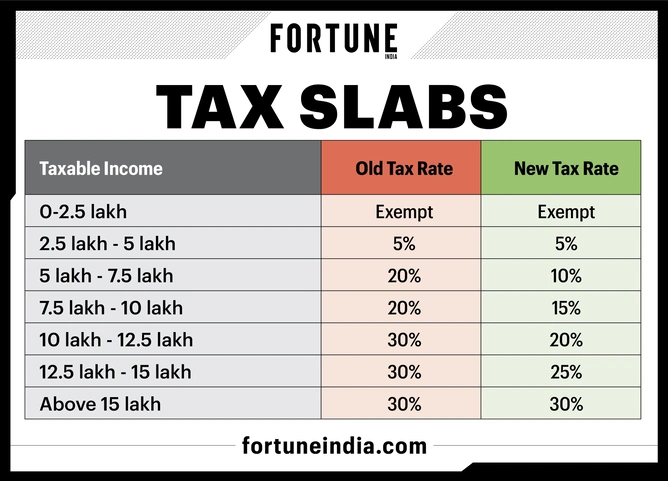

The general slab rates applicable in the case of an individual or HUF are 5 20 and 30. As per the announcement in the latest budget session the introduction of income tax slab 2022 takes the new gross turnover limit of Rs.

Know Types Of Direct Tax And Charges Forbes Advisor India

12500 whichever is less.

. The Bangalore bench of the Income Tax Appellate Tribunal ITAT has allowed income tax deduction in respect of the expenditure towards the issue of ESOP to the. Income tax rate Short-term capital gain from selling an under-construction house is taxable at the applicable income tax slab rates. The tax rate is 25 percent for domestic companies.

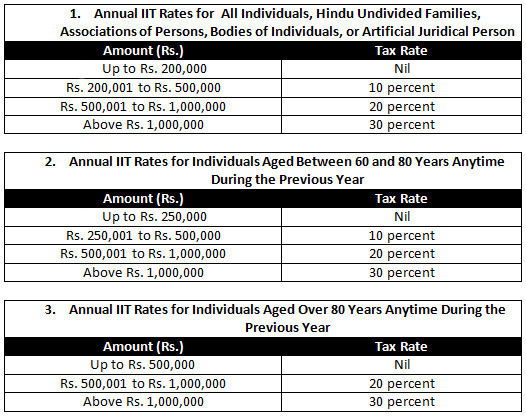

Tax Rates for AY 2022-23. Total turnover in the preceding fiscal year 2018-2019 is not above 400 crores. The Marginal Tax Rate is therefore the tax applicable on every progressive income slab as decided by the government.

Your income tax rate as an NRI depends on the amount of annual income you earn in India. Long Term Capital Gains Tax Rate. Income earned in India.

Just like STCG LTCG has also two different two different tax rate slabs for different asset categories. It is deductible from income-tax before calculating education cess. Specifies the Act under which income from Non-resident Indians will be taxed either the Income Tax Act IT-Act or as per the relevant rates prescribed in the relevant Double Tax.

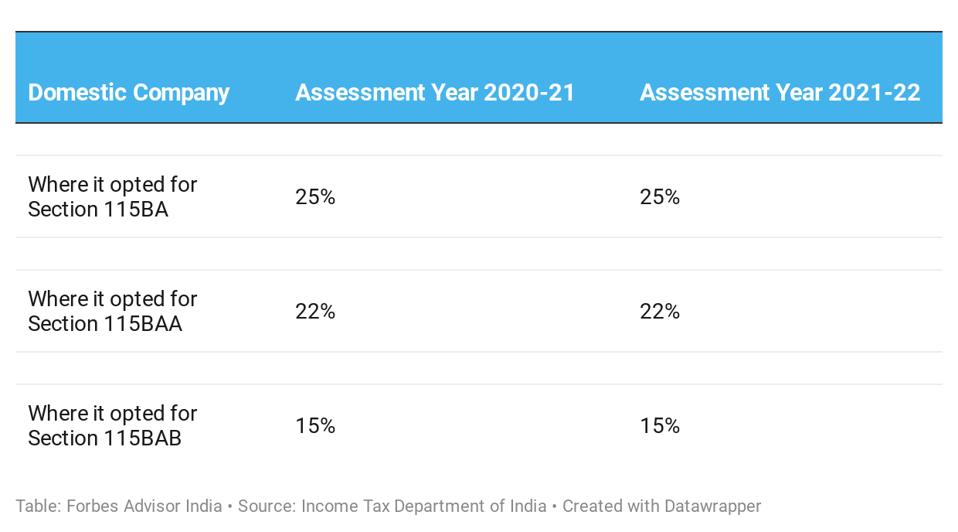

400 Crore for the purpose. The special Income-tax rates applicable in case of domestic companies for assessment year 2022-23 and 2023-24 are as follows. The amount of rebate is 100 per cent of income-tax or Rs.

In addition the surcharge is also payable. If total income exceeds 1 crore but not 10 Crore. 2022 corporate tax rates individual capital gains income tax rates and salary allowances for.

Income Tax Rates for Partnership Firms LLP AY 2022-23. There are various tax slabs relevant to the taxpayers for the. A non-resident company is taxed only on income that is received in India or that accrues or arises or is deemed to accrue.

TUFS means Technology Upgradation Fund Scheme announced. Tax Rates for AY 2021-22. Income tax in India is governed by Entry 82 of the Union List of the Seventh Schedule to the Constitution of India.

RNOR and NR individuals are not subject to tax in respect to their income earned and received outside of India. Income tax rates and thresholds for India in 2022 with supporting 2022 India Salary Calculator. -7 of tax calculated on domestic company 2 of tax calculated on the foreign company as per the.

Partnership Firms LLPs are taxable at a flat rate of 30 on total income. The marginal tax rates according to the old regime are 5. Personal income tax rates.

The highest slab rate of 30 applies on income exceeding Rs. 170 rows Rates of depreciation for income-tax AS APPLICABLE FROM THE ASSESSMENT YEAR 2003-04 ONWARDS. The long-term capital gains after claiming the.

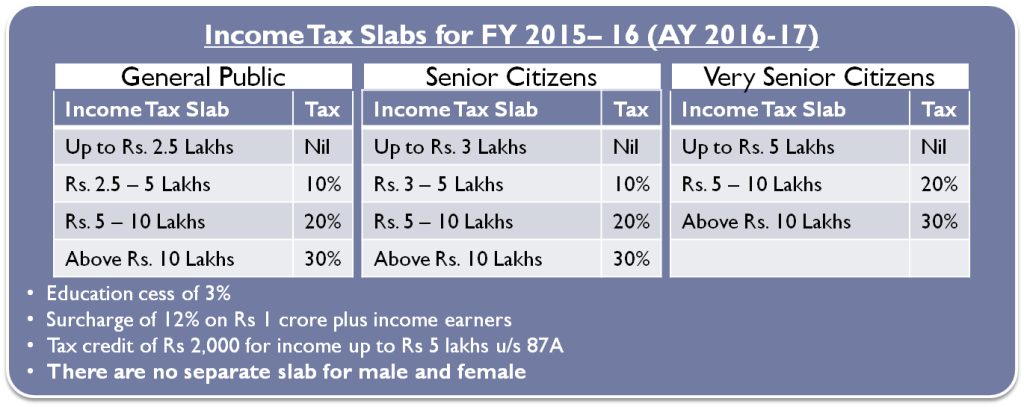

A resident company is taxed on its worldwide income. The slab rates applicable to individuals. As per the current income tax rules in India the income tax rate on resident taxpayers differs depending on their age.

Total turnover in the. Type of Capital Asset. Heres a quick table on the income tax rates per slab⁴.

Fortune India Business News Strategy Finance And Corporate Insight

What Are The Income Tax Rates In India From 1947 To 2017 Quora

India S New Tax Structure For The Year 2012 13 India Briefing News

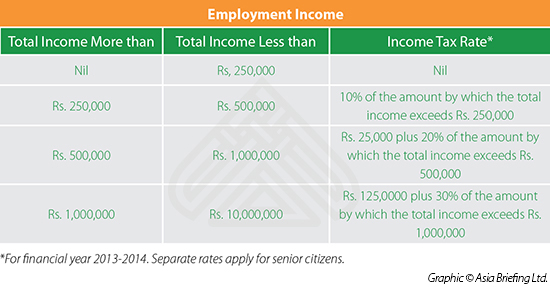

Calculating Expatriate Income Tax In India Asia Business News

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

India S Income Tax Rates May Be Cut But What Reforms Should Accompany Them

Income Tax Rates Slab For Fy 2022 23 Or Ay 2023 24 Ebizfiling

Corporate Tax In India Overview Tax Rates Returns Legalwiz In

Income Tax Slabs History In India

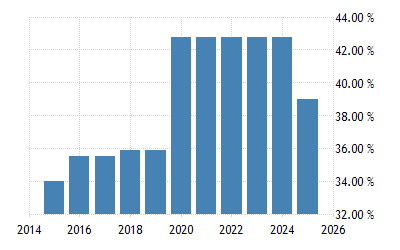

India Personal Income Tax Rate 2022 Take Profit Org

Income Tax Slabs And Rate 2020 2021

The Case For Introducing 35 And 40 Rates For Personal Income Tax Cbga India

India Doesn T Seem Ready For The Introduction Of A Flat Income Tax Regime Mint

Fact Check Were Personal Income Tax Rates Between 1971 72 As High As 93 5 Percent

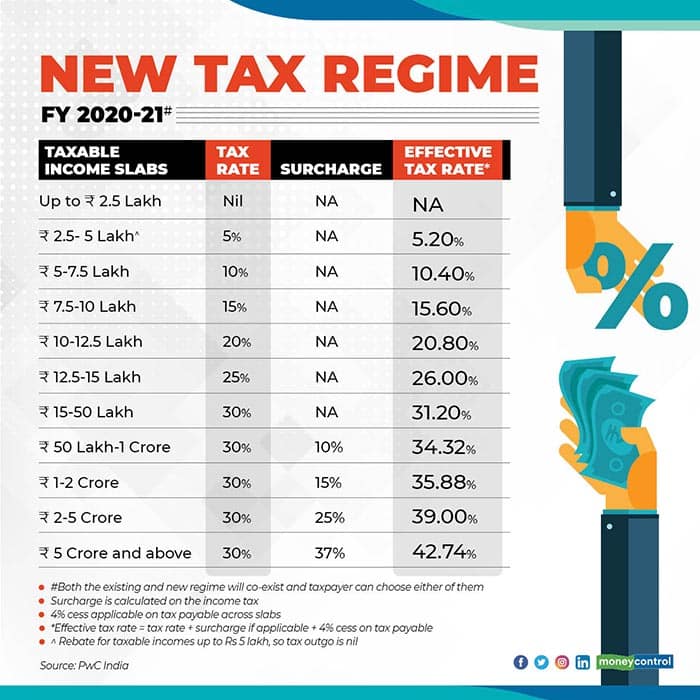

Budget 2020 Should You Switch To The New Income Tax Slabs

Income Tax Slabs For Ay 2021 22

Income Tax In India An Interesting History

How To File Income Tax Returns On India Online As Nri Form Overseas Savingsfunda